A Petty Cash Fund Should Not Be Used for

A travel expense form should be submitted for travel-reimbursement requests. Payment of services rentals prizes or awards must be made through Accounts Payable to facilitate1099 reporting of taxable income.

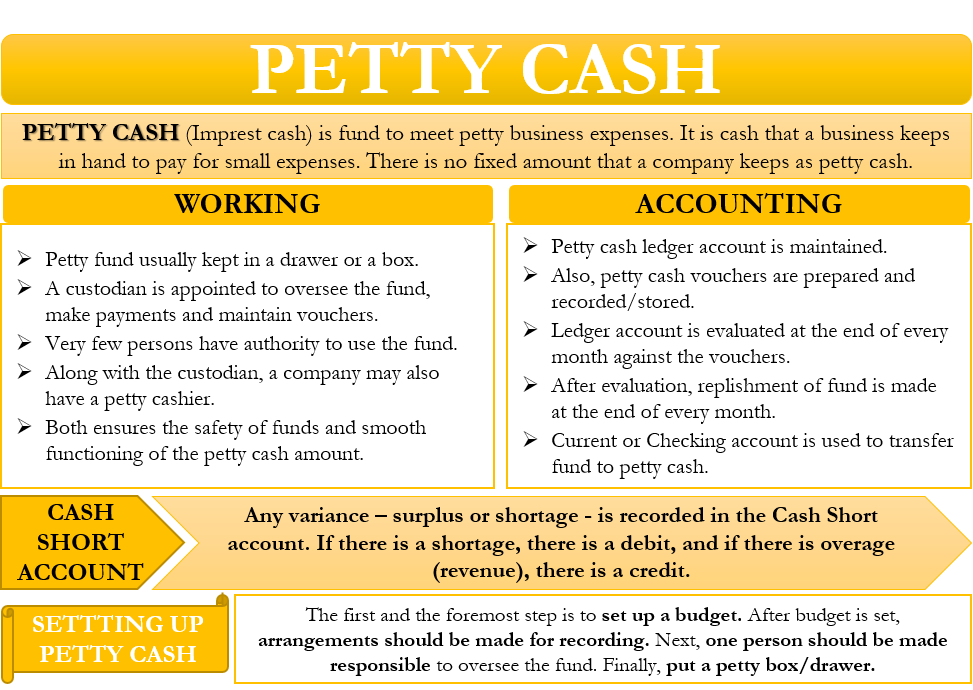

Petty Cash Meaning Accounting How It Works And More

The petty cash fund should not be used to.

. Petty cash funds are not to be used as an operating fund eg petty cash funds should not be used to pay invoices for goods or services to pay salaries or wages or to make advances or loans One employee should be assigned responsibility as custodian of the fund. Purchases over 100 should be made using other procurement methods such as the purchasing card. Petty cash accounts may be used to make cash payments to human subjects in.

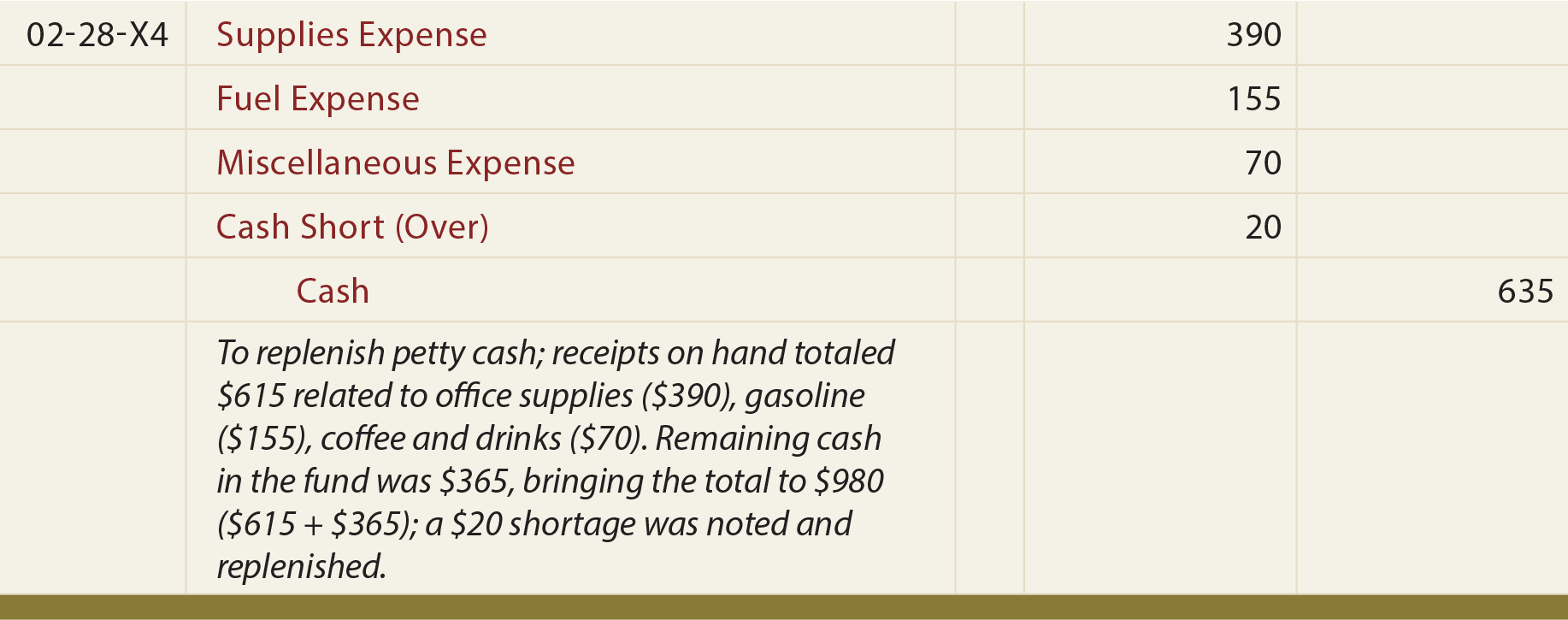

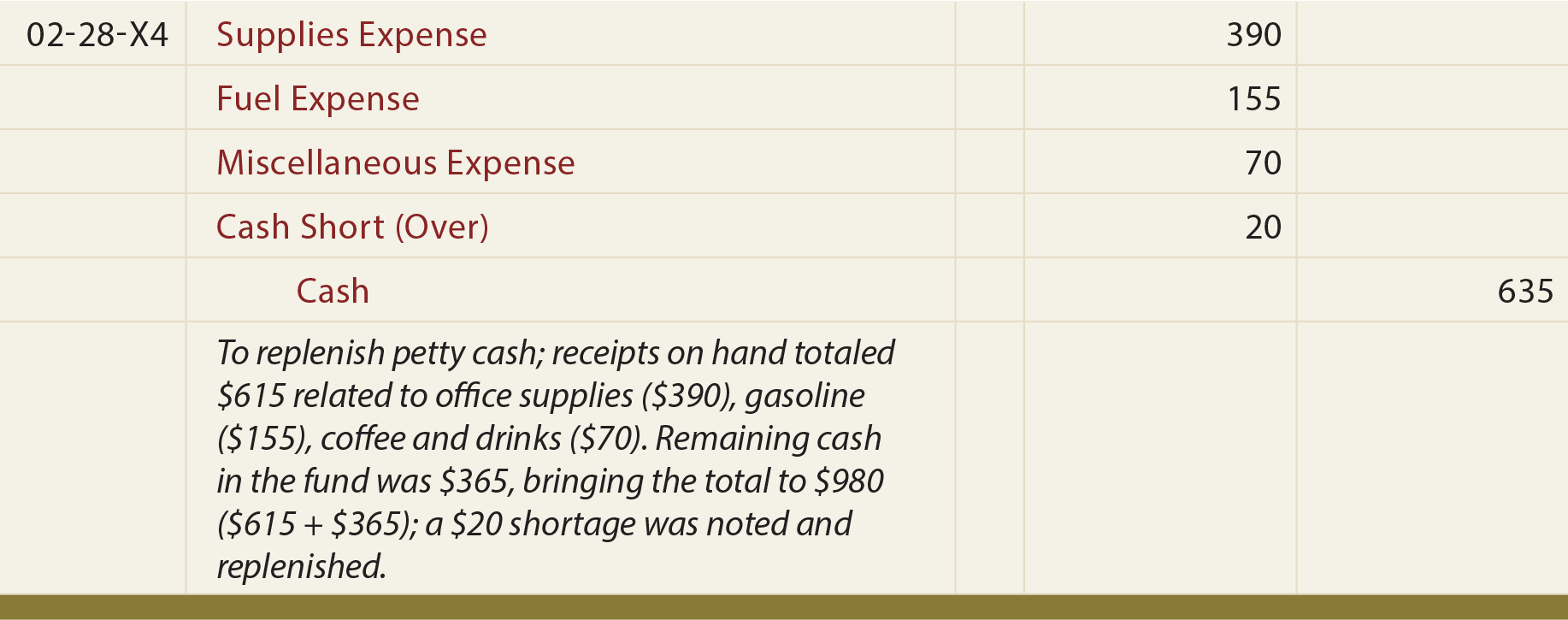

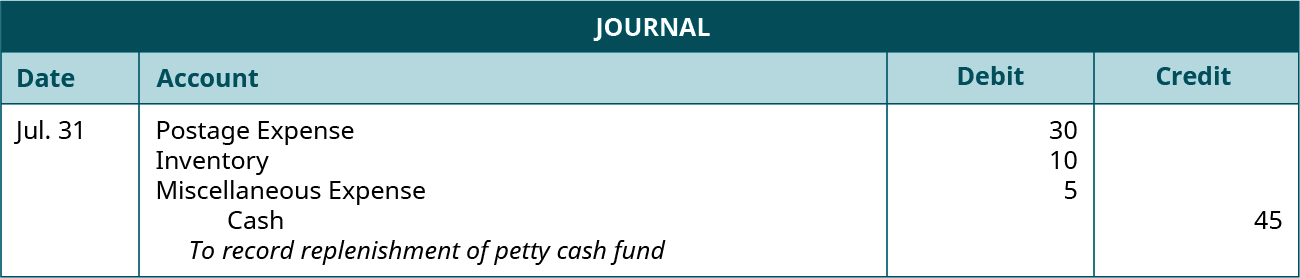

The journal entry to record replenishment is. Personal loans and cashing personal checks. Making small volume purchases when a procurement card is not available.

Set limits to what does and doesnt fit under petty cash. Purchase goods currently covered by the Districts negotiated contracts. Receipts should be given for all payments from petty cash.

Departments may not establish bank accounts for petty cash funds. Petty cash funds must not to be used as an operating fund ie to pay invoices for goods or services to pay salaries or wages or to make advances or loans. After the vouchers have been examined and approved a check is created for 9260 which restores the cash in the fund to its 100 balance.

When a petty cash fund is in use petty cash transactions are still recorded on financial statements. Petty cash is not used in the replenishment journal entry. Petty cash funds must not to be used as an operating fund ie to pay invoices for goods or services to pay salaries or wages or to make advance s or loans.

Funds should not be used for personal expenses. Petty cash funds may be used for the following. Transactions that have reportable services rendered.

Whenever possible local units should use the PCard instead of petty cash. The intent is to simplify the reimbursement of staff members and visitors for small expenses that generally do not Exceed 2500 such as taxi fares postage office supplies etc. Alcoholic beverages for personal consumption.

The petty cash fund should not be utilized for purchases that can be readily procured through the normal University procurement process. Typing photography entertainers caterers etc. Systematic use of petty cash should be discouraged especially for expenditures for which another reimbursement process has already been established.

Petty cash funds may not be used for the following. With careful documentation you should be able to check and see where the petty cash money is going and discourage larger purchases through the petty cash system. Petty Cash custodians are responsible for safeguarding petty cash funds and.

Personal loans and cashing personal checks. Access cash for payments when other disbursement methods are impractical or cannot be used. False For internal control reasons at least 2 people should be responsible for the petty cash fund and the petty cash box should be.

Travel expenses except parkingtransportation services at a university site for non-employees. These funds are not to be used for the payment of small andor non recurring. When Petty Cash May Not be Used.

Petty cash funds may not be used for the following transactions. Stanford Faculty Club dues. Which of the following items appearing on a bank reconciliation require a journal entry to bring the Cash.

Loans to the petty cash custodian C. Petty cash funds may not be used for personal use loans or the payment of services rentals prizes or awards. The journal entry for giving the custodian more cash is a debit to the petty cash fund and a credit to cash.

Its best to put your petty cash policy in writing and provide some examples of appropriate expenses. Payment for services performed by employees or non-employees. Petty Cash is debited when funds are replenished.

When Petty Cash May Not be Used Advances. A petty cash fund is established for the payment of small less than 10 charges or for non recurring charges such as freight. Purchases of goods and services for more than 100 should not be made with petty cash.

Petty Cash is credited when funds are replenished. What should petty cash not be used for. You may also put a limit such as 25 on all petty cash transactions.

Expenses are not recorded. Items that normally would not be deemed as acceptable purchases are prohibited from being purchased with petty cash funds the petty cash. The receipts should contain the date name of individual receiving cash amount of cash and business purpose.

Companies often use petty cash to make change for customers and pay for small unexpected expenses such as office supplies or a small repair. Petty cash funds are not to be used for travel or entertainment expenses. Petty cash funds may not be deposited into personal bank accounts or commingled with other funds.

A petty cash fund should not be used for A. Social or travel club dues. Petty cash accounts may be used to make cash payments.

Petty cash funds should not to be used as an operating fund ie to pay invoices for goods or services to pay salaries or wages or to make advances or loans. For example an employees travel expenses or an outside contractors charges should not be paid from the fund. Flowers coffee greeting cards or other personal consumable items.

This fund is really meant for small immediate purchases. The petty cash fund is reconciled periodically to verify that the balance of. Petty cash may NOT be used for.

A change fund is established to make change at sales locations. Pay personal services ie. Expenses paid with petty cash are recorded when the fund is replenished.

Businesses use a petty cash fund because writing checks for small amounts is costly time consuming and impractical. When a petty cash fund is in use. See the Petty Cash Policy for additional details.

A reconciliation of the petty cash fundcash drawer should be completed and reviewed by the custodians supervisor periodically. Dont let petty cash be used for everything.

Petty Cash Principlesofaccounting Com

Define The Purpose And Use Of A Petty Cash Fund And Prepare Petty Cash Journal Entries Principles Of Accounting Volume 1 Financial Accounting

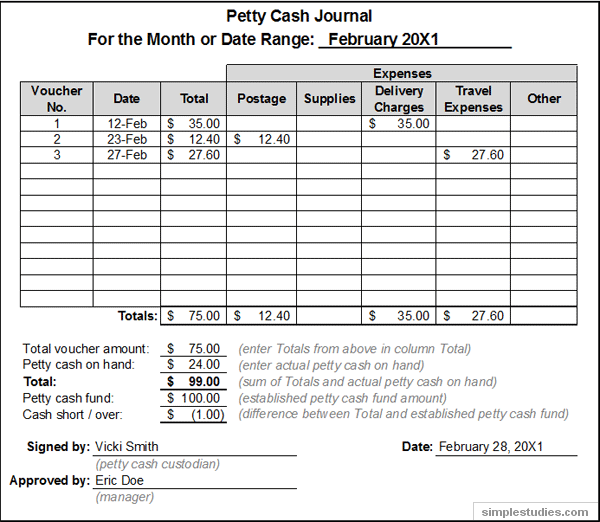

Accounting And Procedures For Petty Cash Accounting Guide Simplestudies Com

No comments for "A Petty Cash Fund Should Not Be Used for"

Post a Comment